The functions, activities, business capabilities, and service measures for Agency Human Capital Strategy, Policies, and Operation Plan; Employee Accountability; Labor Relations; Human Capital Analytics and Employee Records; Agency Human Capital Evaluation; and Personnel Action Request (PAR) Processing (Human Capital Business Reference Model (HCBRM) Functions A1, A7-A10, and X1), and standard data elements for HCBRM Functions A1, A7-A10 are available here: https://www.regulations.gov/docket/BSC-HCM-2023-0004. The business standards website will be updated with these standards soon.

HR Management Services - Compensation and Benefits

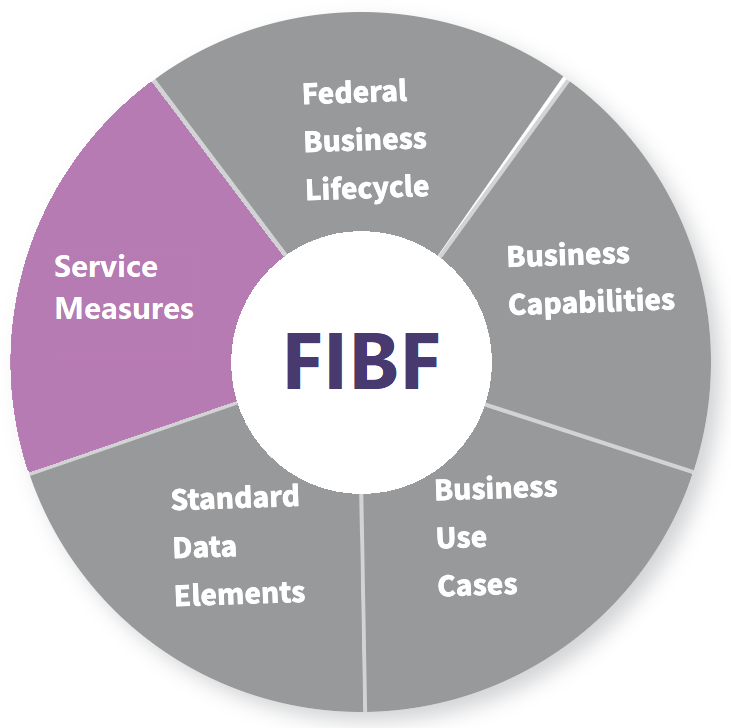

Federal Integrated Business Framework (FIBF)

The FIBF is a model that enables the Federal government to better coordinate and document common business needs across agencies and focus on outcomes, data, processes and performance. It is the essential first step towards standards that will drive economies of scale and leverage the government’s buying power.

HR Management Services Standards Lead

Name: OPM, Human Resources Line of Business

Website: www.opm.gov/services-for-agencies/hr-line-of-business/

References: Human Capital Business Reference Model

Contact: HRLoB@opm.gov

Download Compensation and Benefits Business Standards Components

Federal Business Lifecycle - Compensation and Benefits

Federal Business Lifecycles, functional areas, functions, and activities serve as the basis for a common understanding of what services agencies need and solutions should offer.

Functions: Breakdown of a functional area into categories of services provided to customers.

Activities: Within a function, processes that provide identifiable outputs/outcomes to customers are defined as activities.

Select from the list of available functions to view associated activities

| Identifier | Activity | Description |

|---|

| Identifier | Activity | Description |

|---|

| Identifier | Activity | Description |

|---|

| Identifier | Activity | Description |

|---|

Business Capabilities - Compensation and Benefits

Business Capabilities are the outcome-based business needs mapped to Federal government authoritative references, forms, and data standards.

| Capability ID | Function | Activity Name | Input/ Output/ Process | Business Capability Statement | Authoritative Reference |

|---|

Business Use Cases - Compensation and Benefits

A set of agency “stories” that document the key activities, inputs, outputs, and other LOB intersections to describe how the Federal government operates.

Standard Data Elements - Compensation and Benefits

Identify the minimum data fields required to support the inputs and outputs noted in the use cases and capabilities.

Service Measures - Compensation and Benefits

Define how the government measures successful delivery of outcomes based on timeliness, efficiency, and accuracy targets.